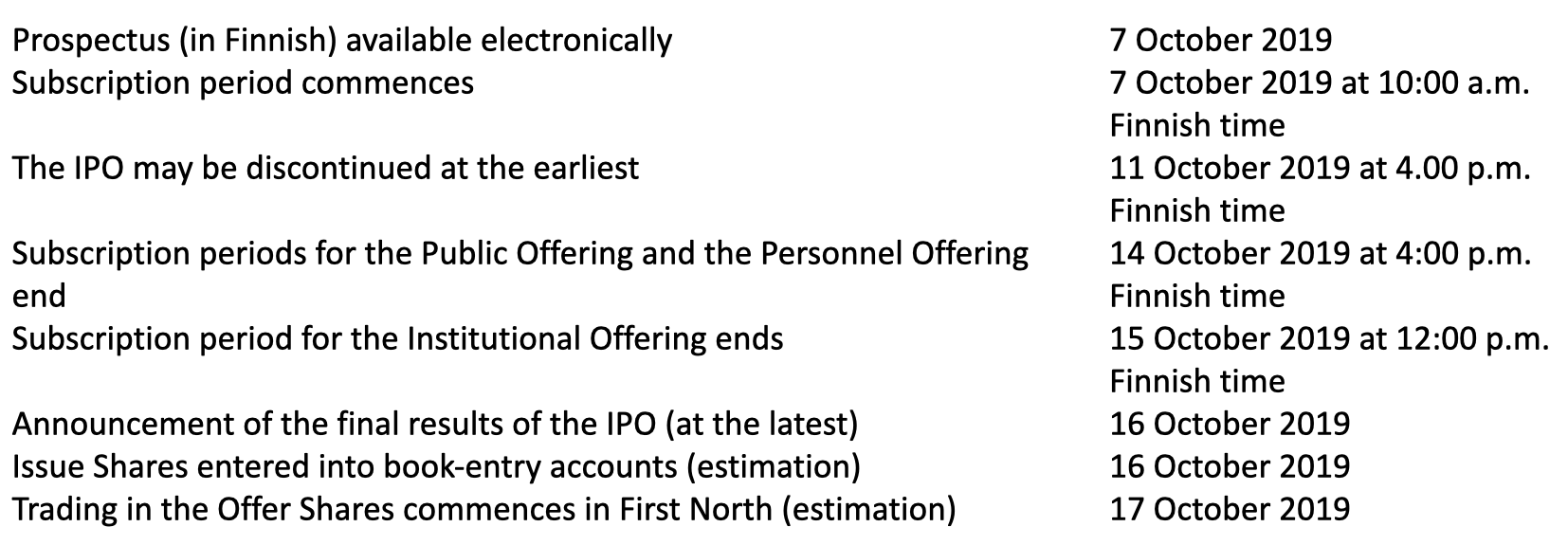

The First North Initial Public Offering of Relais Group Plc, subscription period in the public offering 7 October – 14 October 2019

The First North Initial Public Offering of Relais Group Plc

The First North Initial Public Offering of Relais Group Plc (“Relais” or “the Company”) has ended. The subscription period started October 7, 2019. The Initial Public Offering was oversubscribed and therefore The Board of Directors of the company decided according to the terms and conditions of the IPO on the completion of the Public Offering, the Institutional Offering and the Personnel Offering on 11 October 2019 at 9.20 pm.

The IPO consisted of a share issue (“Share Issue”) and a share sale (“Share Sale”). In the share issue and share sale 4,055,000 shares in total (“Offer Shares”) were offered to private individuals and entities in Finland (“Public Offering”), private placements to institutional investors in Finland, and, in compliance with the applicable legislation, internationally (“Institutional Offering”), and to the salaried employees employed by the company or its group companies during the subscription period, the members of the Board of Directors and of the Management Team of the company (“Personnel Offering”).

The shares were allocated in the IPO as follows:

- in the Public Offering 880,054 offer shares

- in the Institutional Offering 3,135,000 offer shares

- in the Personnel Offering 39,946 offer shares

The company received EUR 20 million from the offering and the sellers received EUR 10 million. The total number of the shares increased to 16,213,800 shares after the new shares offered in the offering were registered in the Finnish Trade Register on October 16, 2019. The number of shareholders after the offering increased to more than 2,000 shareholders.

The subscription price in the public and institutional offering was EUR 7.40 per offer share (“Subscription Price”). In the personnel offering the subscription price was 10 percent lower than the subscription period, i.e. EUR 6.67 per offer share.

Important dates

Trading in the shares commenced on the First North marketplace of Nasdaq Helsinki on October 17, 2019. The ISIN code of the shares is FI4000391487 and the share trading code is RELAIS.

Evli Bank Plc acted as the lead manager in the offering and as the certified advisor according to the Nasdaq First North Growth Market Rulebook. Roschier, Attorneys Ltd. acted as the legal adviser to the company in the listing.

Relais Group’s CEO Arni Ekholm:

”We are delighted by the interest investors have shown in our listing. Relais is a profitable and highly growth-oriented company that creates value for its customers in the field of spare parts and equipment resale for the full duration of a vehicle’s lifecycle. Our goal is to double our turnover in five years, both organically and through acquisitions. Listing will help us implement our strong growth strategy. We want to thank all of our new shareholders for their trust – let’s keep together the wheels of society turning!”, Arni Ekholm, CEO Relais Group Plc.

Investor events

Investor events were held in:

- Valkoinen Sali, Helsinki 7 October at 5:00 pm – 8.00 pm

- Finlayson Palatsi, Tampere 8 October at 6:00 pm – 9:00 pm

- Ravintola Suomalainen Pohja, Turku 9 October at 6:00 pm – 9:00 pm

Releases

Company releases

16 October 2019

The initial public offering of Relais Group Plc has been oversubscribed and the listing will be completed as planned

11 October 2019

Relais Group Plc initial public offering oversubscribed – The subscription periods are closed

7 October 2019

Relais Group Plc applies for its shares to be listed on the First North Growth Market Finland marketplace of Nasdaq Helsinki Ltd

Press releases

4 October 2019

The Finnish Financial Supervisory Authority has approved Relais Group’s prospectus

4 October 2019

Relais Group announces the fixed subscription price for its contemplated IPO and further information on the listing of its shares on the First North Finland marketplace

27 September 2019

Relais Group, one of the leading importers and technical wholesalers of vehicle electrical equipment and spare parts in the Nordics and Baltics, is planning the listing of its shares on Nasdaq First North Finland.

Materials

Prospectus (in Finnish)

Marketing brochure (in Finnish)

Investor presentation

Terms and conditions of the IPO

Articles of Association

Information incorporated by reference into the prospectus:

ABR Financial statements 2018 (in Swedish)

ABR Financial statements 2017 (in Swedish)

ABR Financial statements 2016 (in Swedish)

Huzells Financial statements 2018 (in Swedish)

Huzells Financial statements 2017 (in Swedish)

Huzells Financial statements 2016 (in Swedish)