Relais Group Plc

Press release 27 September 2019 8:30 am

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, NEW ZEALAND, AUSTRALIA, JAPAN, HONG KONG, SINGAPORE OR SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL.

Relais Group Plc (”Relais” or the ”Company”) is planning an initial public offering (“IPO”) and a listing of its shares on the First North Growth Market Finland marketplace maintained by Nasdaq Helsinki Ltd (“Listing”).

Relais Group is an importer and technical wholesaler that actively develops the vehicle electrical equipment and spare parts business in the Nordic and Baltic countries. Relais generates value to its clients by providing electrical equipment, spare parts and specialist services for vehicles in a reliable, efficient and timely manner throughout the vehicle life cycle. Relais acts as a trusted partner to its clients on the aftermarket sector, which is independent from vehicle manufactures, in Finland, Sweden, Norway and in the Baltic countries. As a strongly growth-oriented company, Relais wants to be a forerunner in the field of vehicle lifecycle enhancement in the Nordic and Baltic countries.

In May 2019, Relais completed the strategically important combination with Swedish companies AB Reservdelar (“ABR”), a national wholesaler specialized in spare parts for passenger cars, and Huzells i Karlstad AB (“Huzells”), a national wholesaler of spare parts and equipment for heavy commercial vehicles. In connection with the transaction, the sellers became significant shareholders in Relais through a reinvestment.

Relais has over 150,000 different stock keeping units and sells its products to over 7,000 business customers. On June 30, 2019, Relais employed approximately 260 employees in five countries. In 2018, the reported net sales of Relais were EUR 72.5 million, with EBITA of EUR 8.4 million and operating profit of EUR 5.7 million. On a pro forma basis, illustrating the impact of the ABR/Huzells transaction on Relais, in 2018, pro forma net sales were EUR 119.3 million, with pro forma comparable EBITA of EUR 16.9 million and pro forma comparable operating profit of EUR 9.0 million.

Chairman of the Board of Directors Kari Stadigh comments:

“In the course of its operating history, Relais has grown from a local supplier of electrical spare parts to one of the leading Nordic companies in its field, while maintaining a level of profitability that is among the highest in the industry. The vehicle independent aftermarket will continue to provide Relais with attractive opportunities for value creation also in the future, and we want to be an active player in the consolidation of this market in the Nordic and Baltic regions. The company has a strong track record with regard to its ability to grow profitably.”

Group CEO Arni Ekholm comments:

“Relais plays an important role in the value chain that keeps the wheels of society turning. With transport of people and goods on the rise, the need for vehicle maintenance and repair also grows, in turn increasing the demand for spare and special parts. The industry needs a strong and reliable partner that provides the critical solutions for the various stages of the vehicle lifecycle that keep vehicles moving safely – every day.

Relais’ prospects for growth in the Nordic countries are good and market drivers support our economic development and growth strategy in a defensive market. We are striving for steady, organic growth, exceeding market growth, while also pursuing targeted acquisitions that fit our strategy. Through listing, we are seeking support for the implementation and financing of this growth strategy.”

The objective of the contemplated IPO and Listing is to enable Relais to implement its growth strategy and to increase strategic flexibility by strengthening the Company’s balance sheet. The Listing and increased liquidity would make it possible to use the shares more effectively as a means of payment in potential acquisitions. Furthermore, the Listing is expected to enhance the competitiveness of Relais by strengthening its recognition and brand awareness among customers, prospective employees and investors. The Listing will also allow the Company to obtain access to capital markets and broaden its ownership base both with domestic and foreign investors.

In the contemplated IPO the Company would aim to raise gross proceeds of approximately EUR 20 million, before IPO related fees and expenses.

Relais’ key strengths

- Focus on a wide selection of mission critical niche parts and equipment: Relais offers its customers a wide selection of over 150 000 stock keeping units, combining leading global brands and strong own niche brands for vehicle life cycle enhancement

- Utilisation of state-of-the-art, inhouse developed core digital tools: Relais utilises inhouse developed digital catalogues as a tool that are in frequent use by the Company’s customers and which improve the efficiency of the Company’s internal processes

- Market drivers with defensive characteristics enable stable financial development: The number of vehicles in the market and the amount of vehicle kilometres have shown stable continuous growth in recent years. Additionally, technological development has increased the amount and complexity of electrical parts

- Focus on high value section of the vehicle life cycle – the aftermarket: Relais focuses on the vehicle aftermarket due to its attractive value creation potential over business cycles

- Operative efficiency: Relais has focused on being a wholesaler on national level, which enables its efficient operations

- Track record of strong, profitable growth

- Qualified and experienced management and employees

Creating a platform for accelerated and profitable growth

Relais aims to be the forerunner in the vehicle life cycle enhancement business within the Nordic and Baltic markets. Relais considers the value generated during the whole vehicle life cycle and is focused on what it regards as the most attractive sector – the aftermarket. Relais’ strategy is formed on the solid basis of three key elements, which together form a platform for accelerated, profitable growth:

- Relais aims to continue growing at an average pace exceeding the market growth, which is supported by targeted synergies, e.g. cross-sales between the existing and acquired entities.

- Relais aims to create customer value through Relais’ comprehensive product range, digital platform and superior customer service.

- Relais strives to continue targeted acquisitions and aims to be an active player in the consolidation of the Nordic and Baltic vehicle aftermarket sector.

Relais plans to capitalise on the growing addressable market, with approximately 19 million passenger cars and commercial vehicles already on the road in the Nordic and Baltic countries.

Financial targets and dividend policy

Relais aims to double its turnover in five years. The Company aims to grow through a combination of organic growth and acquisitions.

- Organic growth: The Company targets to continue growing at an average pace exceeding the market growth, which is supported by targeted top-line synergies, e.g. cross-sales between the existing and acquired entities.

- Based on Relais management’s view, the overall market has been growing during the recent years at moderate but stable rate of approximately 1–3 percent annually, depending on product category and geography.

- M&A based growth: The Company targets to make 1–2 add-on acquisitions per year.

- Targeted synergies from combination with ABR and Huzells: Relais Group aims to achieve considerable synergies with long term impact from the combination with ABR and Huzells. Synergies are expected to be realised from cross-selling between group companies and from purchasing. In the mid-term by 2021, Relais targets annual net sales synergies of EUR 6-8 million. Synergies are expected to have an impact from financial year 2020 onwards.

Relais’ dividend policy is to target annual dividends that exceed 30 percent of the average comparable profit of the Group, excluding amortization of goodwill, over a business cycle. In proposing the dividend, the Group’s equity, long-term financing and investment needs, growth plans, liquidity position, acquisition opportunities, the requirements of the Companies Act for distribution of dividends and other factors that the Company’s Board of Directors consider important are taken into account.

Outlook 2019

Relais provides a financial guidance for the six month period of July 1, 2019 to December 31, 2019. This period includes the full impact of the ABR/Huzells transaction. Due to certain degree of seasonality in the Company’s business, the Company has typically generated a higher proportion of its annual net sales and profitability during the second half of the financial year.

EBITA for the six month period of July 1, 2019 to December 31, 2019 is estimated to total EUR 8-10 million.

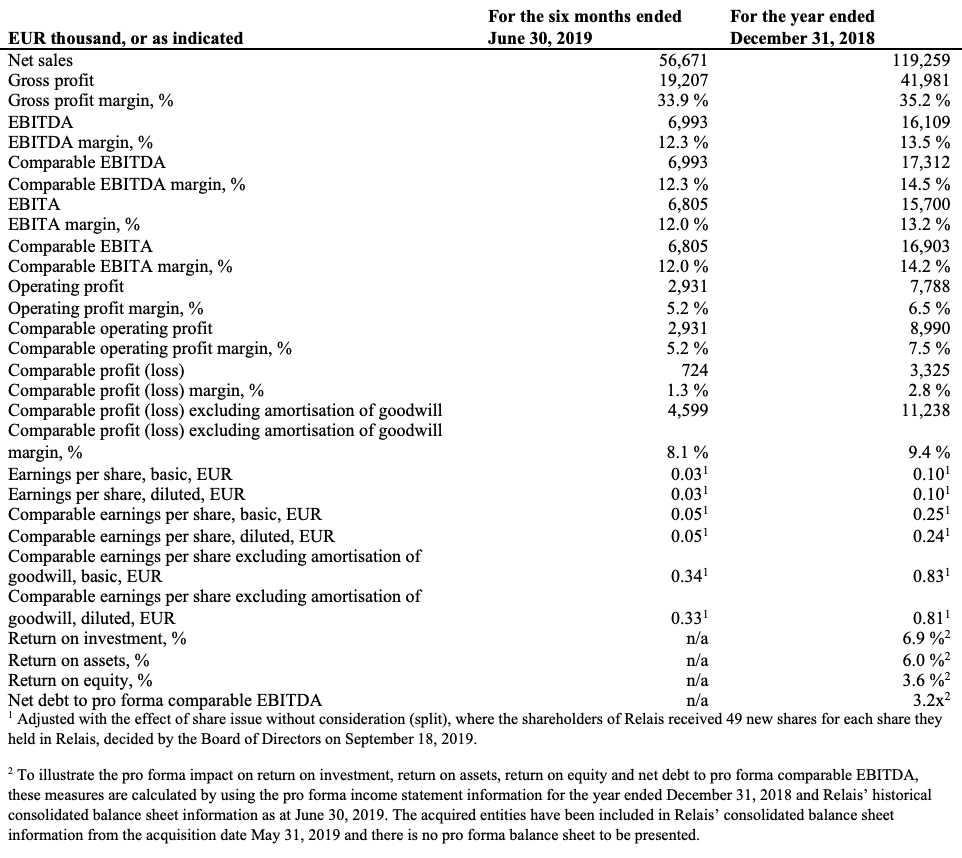

Pro forma key figures

The preliminary unaudited pro forma financial information illustrates the effects of the ABR/Huzells transaction and related refinancing to Relais’ financial information. The preliminary unaudited pro forma financial information has been prepared for illustrative purposes only and it reflects a hypothetical situation. The purpose of the preliminary unaudited pro forma financial information is to illustrate how Relais’ financial performance for the six months ended June 30, 2019 and for the year ended December 31, 2018 may have appeared had the businesses been combined and refinancing completed at January 1, 2018. The preliminary unaudited pro forma financial information does not reflect any cost savings, synergy benefits or future integration costs that are expected to be generated or may be incurred by Relais.

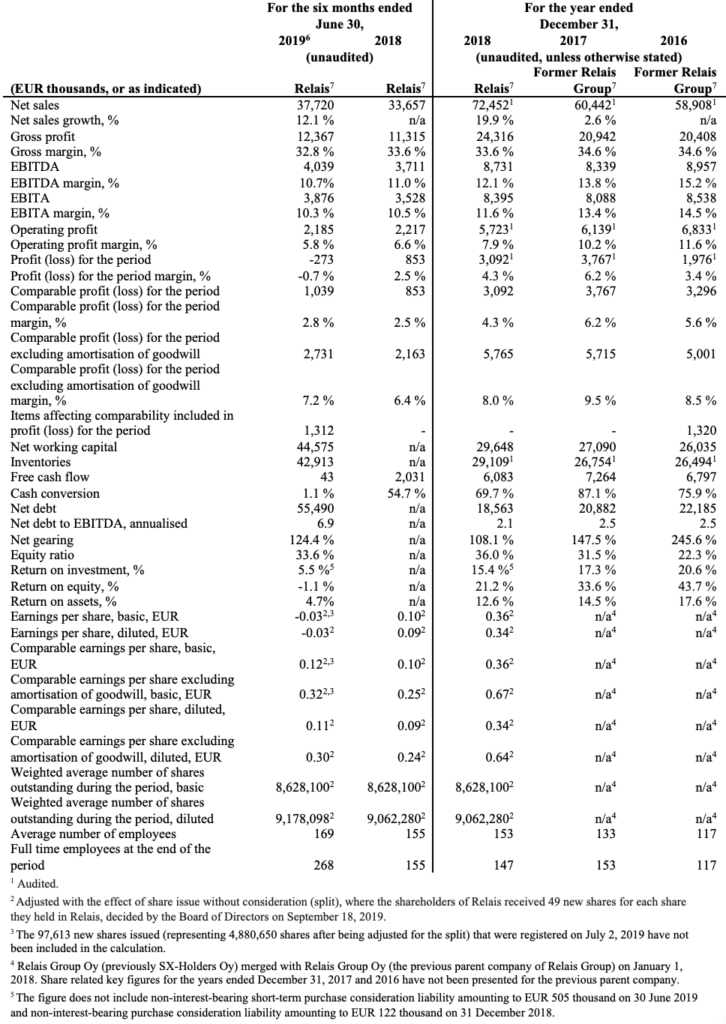

Key figures (reported)

Information on the potential IPO

The contemplated IPO is expected to consist primarily of a primary offering where the Company issues new shares, whereby the Company would aim to raise approximately EUR 20 million of new equity before IPO related fees and expenses. Additionally, certain shareholders have preliminarily committed to offering shares for sale to new investors for up to approximately EUR 10 million. The contemplated IPO is expected to include personnel offering to the management and employees of Relais.

Major shareholders of Relais are Ari Salmivuori and Ajanta Oy1, and Nordic Industry Development AB2. Other shareholders primarily comprise members of the Board of Directors, Management team members and other key employees.

The Company will decide on the contemplated Listing and IPO, and timing thereof at a later date.

Evli Bank Plc would act as the Lead Manager in the contemplated IPO. The Company’s legal adviser is Roschier, Attorneys Ltd.

Press conference

Relais will host a press conference today, 27 September 2019 at 9:30 am onwards (Finnish time), at Nasdaq Helsinki Stock Exchange (Fabianinkatu 14, Helsinki).

Further information:

Relais Group Plc

Arni Ekholm, CEO

email: arni.ekholm@relais.fi

+358 40 760 3323

Certified Adviser:

Evli Bank Plc, tel. +358 40 579 6210

Relais Group in brief

Relais Group is an importer and technical wholesaler that actively develops its vehicle electrical equipment and spare parts business operations in the Nordic and Baltic countries. Relais creates added value for its customers by offering vehicle spare parts, equipment and specialist services throughout the life cycle of vehicles in a reliable, efficient and timely manner. As a strongly growth-oriented company, Relais aims to be an industry forerunner in the vehicle life cycle enhancement business. The pro forma net sales of Relais Group amounted to EUR 119 million in 2018. The company employs more than 260 people in five countries.

www.relais.fi

NOTE

The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States, Canada, New Zealand, Australia, Hong Kong, South Africa, Singapore or Japan.

This release does not constitute an offer of securities for sale in the United States, nor may the securities be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. The Company does not intend to register any portion of the offering in the United States or to conduct a public offering of securities in the United States.

The issue, exercise and/or sale of securities in the initial public offering are subject to specific legal or regulatory restrictions in certain jurisdictions. The Company and Evli Bank Plc assume no responsibility in the event there is a violation by any person of such restrictions.

This release contains forward-looking statements including statements concerning the Company’s strategy, financial position, profitability, result of operation and market data as well as other statements that are not historical facts. Statements which include the words “will”, “estimate”, “predict”, “continue”, “anticipate”, “presume”, “may”, “plan”, “seek”, “become”, “aim”, “believe”, “could” and other similar expressions or their negative forms indicate forward-looking statements, but forward-looking statements are not limited to these expressions. By nature, forward-looking statements involve risks, uncertainties and numerous factors that could result in the actual consequences or results of operations differing materially from projections. Readers should not place undue reliance on these forward-looking statements.

The information contained herein shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of the securities referred to herein in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction. Investors must neither accept any offer for, nor acquire, any securities to which this document refers, unless they do so on the basis of the information contained in the applicable prospectus published or offering circular distributed by the Company.

The Company has not authorized any offer to the public of securities in any Member State of the European Union other than Finland. With respect to each Member State of the European Union other than Finland and which has implemented the Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market (the “Prospectus Regulation”) (each, a “Relevant Member State”), no action has been undertaken or will be undertaken to make an offer to the public of securities requiring publication of a prospectus in any Relevant Member State. As a result, the securities may only be offered in Relevant Member States (a) to any legal entity which is a qualified investor as defined in the Prospectus Regulation; or (b) in any other circumstances falling within Article 1(4) of the Prospectus Regulation.

This communication is directed only at (i) persons who are outside the United Kingdom or (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

1 Ajanta Oy is a company controlled by Ari Salmivuori.

2 The previous owner of ABR and Huzells. Member of the Board Jesper Otterbeck holds indirectly 50 percent of the shares and votes in Nordic Industry Development AB.